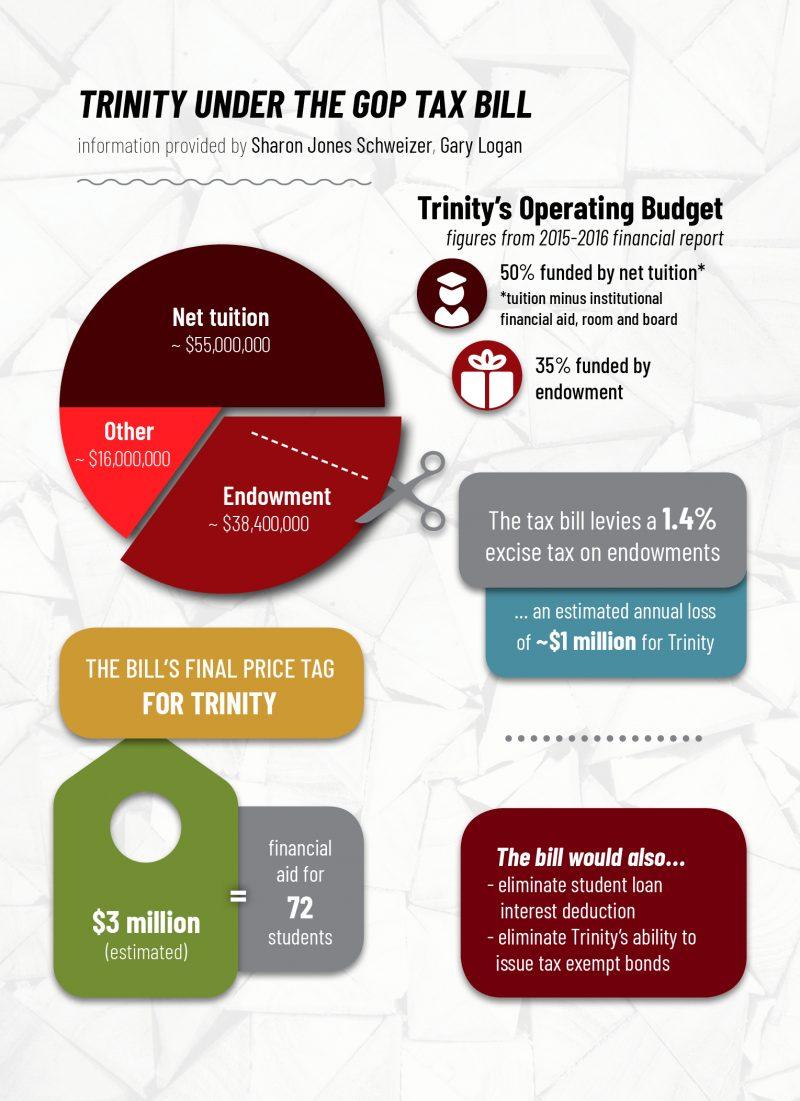

Proposed plans for tax reform are currently making their way through the United States House of Congress and the Senate. While there are still many hurdles to clear, the bills could impose a 1.4 percent tax on net investment income derived from private universities’ endowments — including Trinity’s.

The proposed tax would apply to private schools with at least 500 enrolled students, with the House bill qualifying universities with endowments at over $100,000 per student and the Senate bill applying to universities at over $250,000 per student. Under either version of the bill, gains on Trinity’s endowment would be taxed; under current law, the endowment is tax-exempt. The tax bills would also repeal interest cuts on student loans.

Endowments at universities consist of donations that are traditionally used to fund operating costs, pay professors and provide financial aid for students. Critics of large university endowments liken them to hoarding, as often the endowed asset is kept intact, and the income generated by it is used each year. Trinity’s endowment is close to $500,000 per student, placing the school firmly in the taxation threshold, ranked 26 among about 70 other qualifying schools.

Sharon Jones Schweitzer, assistant vice president of external relations, commented on the potential effects of a hit to Trinity’s endowment.

“Trinity University’s endowment funds more than 35 percent of the university’s operating budget. The endowment funds scholarships, financial aid and academic programs,” Schweitzer said. “We were able to provide $43 million in financial assistance in 2015–2016, with more than 93 percent of our students receiving some form of merit- or need-based aid. Students are the beneficiaries of our endowment. The proposed tax will ultimately hurt parents and students seeking a high-quality education.”

Schweitzer also said that while Trinity is not opposed to reform, there are many aspects of the Senate and House bills that will be harmful to Trinity students.

“Trinity University supports tax reform, but the provisions in the proposed legislation will cost the university an estimated $3 million a year. This would represent aid for more than 72 students,” Schweitzer said. “Another provision in the tax reform legislation proposes to eliminate the student loan interest deduction, which negatively impacts so many young graduates as they are on the path to establishing themselves and launching a career. The bottom line of the proposed tax reform bill will increase the cost of higher education for the vast majority of students and families.”

Finlay McCracken, a senior triple-majoring in economics, history and French, criticized the proposed reform, specifically the part targeting student loans.

“Raising interest rates on student loans makes student loans harder to get. If such a policy were coupled with a concerted effort to reduce tuition, like with tuition subsidies, federal money to universities, etc., I might be able to get behind it,” McCracken said. “I don’t think we need to make it harder for people to have access to education, which is increasingly vital to having a good job in a city in the United States.”

Schweitzer reported that university officials have been working on protecting the endowment by reaching out to government representatives.

“Earlier this month, President Anderson sent a message to faculty and staff informing them of the proposed tax legislation and its potential impact on colleges like Trinity. He encouraged all who wanted to express their concerns to contact their elected officials,” Schweitzer said. “Dr. Anderson has also been reaching out to members of the Texas Congressional delegation, including those who are Trinity alumni, Senator John Cornyn and Representative Michael McCall. He’s been visiting with a number of elected officials to provide them with information about the potential impact of the proposed excise tax on endowment earnings and other provisions the university believes will make a college education more expensive and less accessible.”

Gary Logan, vice president for finance and administration, commented on how Trinity could deal with the potential tax increase.

“The University has not determined exactly how to manage this loss in endowment value and related loss in budget support,” Logan wrote in an email interview. “However, there are only a few options available that are financially viable — pass the loss of revenues on to current students through increased costs, pass the loss on to future generations of students through loss in value in endowment and thus loss future budget support, reduce expenses in order to offset the budget impact or some combination of the these measures.”

Schweitzer added that the timing of the proposed reforms is especially inconvenient.

“All of this comes at a time when America needs more college graduates that are immediately ready to make significant and lasting contributions to our economy and society,” Schweitzer said.