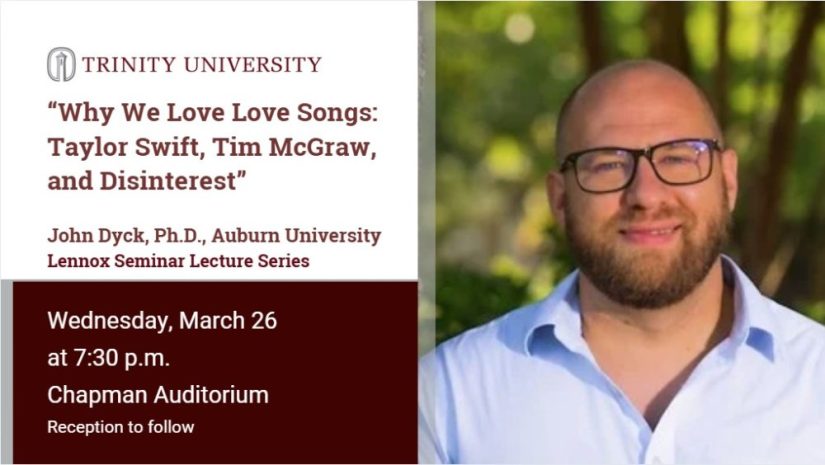

Photo by Matthew Claybrook

Graduate accounting student Abby Kluetz always knew she wanted a career that somehow involved math and business. She spent high school exploring career options, unsure of her goals; for a while, her dream was to become a wedding planner. Finally, her dad had her sit down and take a career aptitude survey. Accounting came up as one of her top five career matches.

However, Kluetz wasn’t sure she wanted to study accounting until her first year at Trinity, when she took Fundamentals of Financial Accounting with Linda Specht.

“It took me coming to Trinity and taking the 1301 course with Dr. Specht, who’s incredible, when I was like, ‘I’m good at this. I like this,’ ” Kluetz said. “I would say the professors drew me in because the professors are really great. And then I like the math side of it, although I know that it’s a lot less math than people think it is. It’s a lot more writing than math.”

Trinity’s accounting program has several benefits: It boasts easy access to internships at the Big Four accounting firms, high Certified Public Accountant (CPA) exam pass rates and a near 100 percent job placement post-graduation. There are two separate parts to the program — the four-year undergraduate degree in accounting and the one-year graduate program. Though not all students who complete their undergraduate degree go on to pursue a master’s degree at Trinity, a master’s is usually necessary to sit for the CPA exam.

“In order to sit for the CPA exam and become a CPA, you have to have 150 hours [of coursework], and you have to have 30 upper-division hours in accounting,” said Julie Persellin, chair of the accounting program. “In order to get that and to be eligible to sit for the CPA exam, you basically have to get a master’s degree. So, the reason for the degree really has a lot to do with the fact that these students didn’t go through their entire accounting degree not to become a CPA. That’s a big deal.”

Completion of an internship is also not required to receive an accounting major, but Trinity’s program makes it easy for majors to work for an accounting firm during the second half of their senior year. In the spring of their junior year, accounting majors are able to attend a job fair, when an array of public accounting firms, including the Big Four — KPMG, Ernst & Young (EY), Deloitte and PricewaterhouseCoopers (PwC) — hold interviews on campus.

According to Persellin, nearly every qualified student is able to secure an internship as a result of the job fair. After they graduate from the five-year accounting program, many students will go on to work full-time for the firm where they interned.

“I would say 90 percent [of accounting students] go to one of the Big Four accounting firms when they [graduate],” Persellin said. [Trinity is] one of the few smaller schools that really all of the Big Four heavily recruit from. It’s a big draw because those firms are international firms. They provide tremendous opportunities for students after they graduate.”

Accounting internships begin in January of students’ senior year and conclude in March, around spring break. Internships are worth six credit hours. Students return to campus after the break for a “mini-mester” to complete the other six credits required to be a full-time student.

“They take two classes in the mini-mester. They’re normal three-hour classes; they’re just doubled up on after spring break. So really they do get 12 credit hours … It would be extremely difficult otherwise for students to be able to take a whole semester off,” Persellin said.

Senior accounting major Matthew Shea has secured an auditing internship with Deloitte. He got a chance to visit Deloitte’s campus in Houston, and he enjoyed meeting the individuals who make up the company.

“I chose Deloitte mainly because of the people. There are a lot of Trinity [alumni] at Deloitte in Houston. They’re just really friendly and helpful,” Shea said.

Though he hasn’t completed the internship yet, Shea figures he will remain at the firm for at least a couple of years after he graduates.

“My mom is a business consultant, and a lot of the Big Four firms have consulting sides to them, so I might transition to consulting eventually, but if I enjoy public accounting, I have no problem staying there,” Shea said.

Persellin explained that students sometimes start out in public accounting but eventually switch to a more corporate environment, often going to work for companies that they’ve been exposed to through their accounting firms.

“A lot of people will end up going to work for some of the corporations that they maybe had exposure to when they were in public accounting. They’re able to see a lot of different industries, so they may, you know, get into oil and gas and say, ‘You know what? I love this.’ And so, they go work for maybe one of the oil and gas clients that they had exposure to. So you see a lot of people go into corporate accounting,” Persellin said.

However, Persellin explained that an accounting education can also help with a wide variety of career paths.

“I’ve seen someone turn around and open an art gallery because they’ve got the accounting background, and they kind of know how to do that,” Persellin said. “Having that background in accounting really lends itself to so many other professions, just because when you know how to run a business, that applies to any business.”

Those interested in learning more about the accounting major or graduate program at Trinity can contact Julie Persellin at jpersellin@trinity.edu.