Graphic by Quinn Butterfield

Increasing uncertainty in the global economy, an ongoing trade battle with China and a full quarter of an inverted U.S. bond yield curve all point to an oncoming economic recession — the biggest threat to Trinity University’s endowment, according to Gary Logan, vice president for finance and administration.

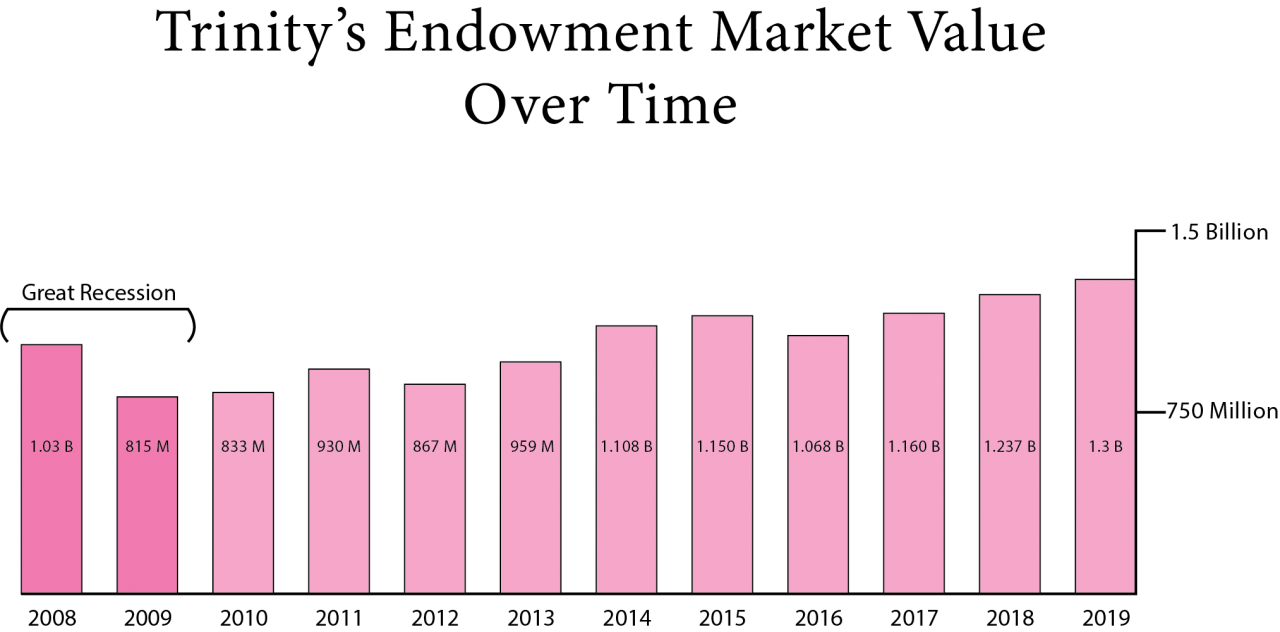

The endowment’s market value currently sits at around $1.3 billion. There are 29 professorships and 291 scholarships supported by the endowment. Last year, endowment revenue provided more than $30 million for scholarships and supported about a third of Trinity’s annual operating budget.

“Well clearly if we have a severe recession, that does the most damage to the endowment,” Logan said.

During the Great Recession from 2008 to 2009, the endowment’s market value dropped over 20% from $1.03 billion to $815 million.

Over a decade later, another economic recession appears imminent. The yield curve on U.S. bonds recently inverted, meaning interest rates on short-term bonds are higher than interest rates on long-term bonds. An inverted yield curve has preceded all nine recessions in the past six decades, according to the Federal Reserve Bank of San Francisco.

Forecasting an economic downturn is difficult, but the escalating trade war between the U.S. and China is another troublesome sign for the global economy, according to David Macpherson, E.M. Stephens professor of economics and chair of the economics department.

“It’s hard to predict because if I could, I’d be rich,” Macpherson said. “But these trade wars are a recipe to have a recession.”

In the event of an economic decline and accompanying decrease in the endowment’s market value, Trinity’s operating budget won’t be immediately impacted. The amount of money from the endowment allocated to the budget is determined through a “smoothing formula” intended to mitigate the effects of sudden economic shifts.

“The idea of that is to provide some stability,” Logan said. “It slows down the spending that comes into the operating budget when market values are rising very rapidly, which they did a couple of years ago, and it helps ease the pain to the operating budget when [the market value of the endowment] goes back down.”

The amount of endowment funds allotted to the budget is based on a one-year-delayed, 12-quarter average of the endowment’s market value. If the economy crashes during the 2019–20 fiscal year, the operating budget won’t be impacted until the 2021–22 fiscal year. However, in the years following the Great Recession, Trinity’s operation budget was largely unaffected due to the smoothing formula and to a relatively quick market recovery, according to Logan.

Logan also said the endowment is widely invested. Trinity controls most of the funds, and the Bank of Oklahoma Trust Company manages about a third of the endowment.

“We have a very diversified portfolio of investments. Theoretically, those are non-correlated asset classes,” Logan said. “So you would like to think — it doesn’t always work out this way, but most of the time it does — not all of the asset classes go up at the same time and not all of them go down at the same time.”

While the endowment’s market value is protected by diversity of investment and the operating budget is stable due to the smoothing formula, Trinity University alumni relations and development is focused on growth.

Michael Bacon, vice president of Alumni Relations and Development, was hired in 2015. Since then, fundraising has increased each fiscal year, including a 51% increase last year. Bacon said he has assembled an effective group of major gift officers, whose job is to raise funds. Major gift officers are expected to raise five to eight times as much money from donors as they are paid by the university.

“I think it’s safe to say this is one of the strongest teams we’ve ever had,” Bacon said.

In addition to a strong fundraising team, Bacon said Trinity also has a stable endowment largely thanks to the restraint of past and present administration, who chose to only use 4.5 percent of the endowment’s average market value toward the annual operating budget.

“When you compare us to other schools or even nonprofits, they’re probably taking a bigger draw from the interest income than we do,” Bacon said. “I think we’re really lucky that past boards have been so conservative and that our current board is conservative because that has enabled our endowment to grow, even in times that have been up and down.”

In the past, a full quarter — three months — of an inverted yield curve has preceded an economic recession by about seven months to two years. On June 30, that indicator light began flashing.