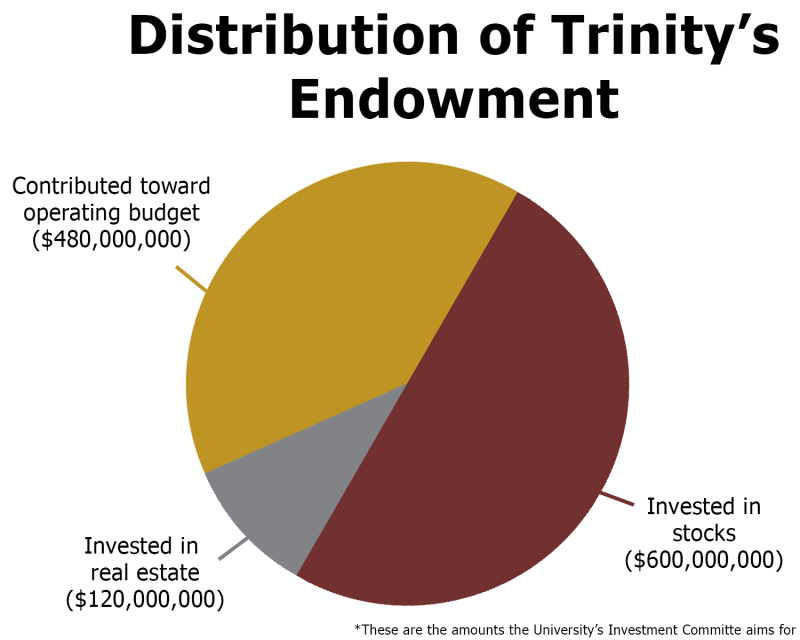

Managing Trinity’s $1.2 billion endowment is no small feat for the Investment Committee of the Board of Trustees.

The endowment staff helps to support and carry out their investment operations. As of the 2016–2017 Endowment Report, Trinity’s endowment has a market value of $1.2 billion.

“[The endowment] can change two ways: New gifts coming in and investment returns,” said Craig Crow, director of investment for Trinity in the Office of Finance and Administration. “The value will fluctuate. Year-to-year markets can be what we call volatile, so they can go up, they can go down. Our market value will vary based on that.”

The endowment distribution supports 35 percent of Trinity’s operating budget, which is almost double the amount of what similar private universities’ endowments supports.

“Operating budget is comprised of annual revenues and expenses to run the university,” said Gary Logan, vice president for Finance and Administration. “Revenues include student net tuition, room and board, as well as a portion of endowment used to support the one-year budget, as well as all operating expenses of the university.”

Along with supporting the operating budget, the endowment is invested to generate revenue. The Investment Committee meets quarterly and Crow looks at the investment operations daily to figure where to allocate funds.

“Trinity’s endowment, like most modern endowments, is more heavily weighted to various equity investments than to fixed income investments,” Logan said. “Equity investments include U.S. and non-U.S. public equities, private equities, venture capital, minerals and real estate.”

The aim of the investment committee is to invest about 50 percent of the endowment in stocks and about 10 percent in real estate, though these numbers can vary.

“We have our targets, and then we have ranges. And the ranges are pretty wide, so we can allocate or reallocate investments based on those ranges depending on where we’re at on certain parts of the market,” Crow said.

Although stocks are a good investment for the long run and have a higher rate of return than real estate. David Macpherson, chair of the Department of Economics, said that stocks can be tricky in the short run due to frequent fluctuations.

“Since the returns of real estate and stocks are not perfectly correlated, it makes sense to invest in both real estate and stocks since such diversification can reduce the risk in an investment portfolio,” Macpherson wrote in an email interview.

Over the past 10 years, the endowment has stayed above $800 million and is now $1.2 billion, its highest number yet. As a major source of continued revenue, the endowment directly affects Trinity life and resources.

“All that stuff that makes Trinity special, the endowment helps do that,” Crow said. “Our job here, my job here at the endowment is to earn the best return we can with the right amount of risk to be able to support everything that this school has going on.”