Biden’s student loan forgiveness plan struggles in the courts

Nearly half of Trinity’s student body could stand to benefit from the plan going through

COVID impacted people’s lives in a multitude of ways, but especially financially. People with student loans struggled with federal student loan payments, and in an effort to alleviate this financial strain, a federal loan payment pause was enacted once Biden took office. This pause has been extended numerous times, but the final extension will be through December 2022. Taking its place at the end of this extension is a student loan forgiveness plan.

The Biden-Harris Administration’s Student Debt Relief Plan was officially announced in August 2022, and the application opened on October 14. This act will remove up to $20,000 for Pell Grant recipients and $10,000 for non-Pell Grant recipients from their total debt amount. This three-part plan outlines the eligibility criteria to receive loan forgiveness and states the proposal for an income-driven repayment plan.

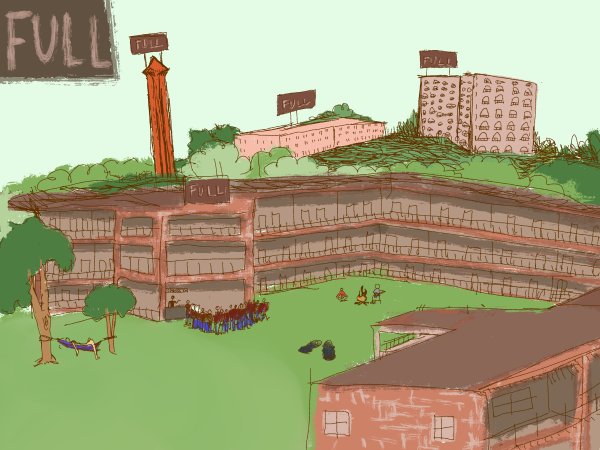

Those applying may only receive forgiveness for loans taken out before June 30, 2022, and the application will close on Dec. 31, 2023. Possible applicants include almost half of the student population at Trinity. According to Lazaro Rodriguez, the associate director of financial aid at Trinity, many students at Trinity have taken out federal loans.

“[The percentage of students who have taken out loans at Trinity] is at about 48% right now,” Rodriguez said. Almost all of these students, 46% of all Trinity students, are also taking out federal student loans.

However, the timeline for the plan and its application process may alter significantly due to backlash and legal complications. Recently, the plan has been temporarily blocked, as Nebraska v. Biden works its way through the courts. Since the plan was put in place by the executive branch, rather than through Congress, a number of states sued, arguing that it was enforced unconstitutionally. As a result, the application process has been halted. People may still submit applications, but action cannot take place until the block is lifted.

The outcome of this court case, whether or not the plan is judged to be constitutional, may solidify voter loyalty or be a further campaign point. David Crockett, the department chair of political science at Trinity, discussed that the outcome may not be the determinant of someone’s ideological label, but it may solidify loyalty to one party or another.

“It’s not going to somehow move large sums of voters in favor of one party over to the other one, [but] … we know that a fairly large majority of college-aged students tend to vote Democrat, so one could argue this might solidify that,” Crockett said.

Even if the plan is found to be unconstitutional, it may still leave its mark. Crockett mentioned that the Democratic party could use that block for campaigns too.

“It could even be possible if that policy fails. It could become a really big campaign issue. Republicans oppose this or Republican-appointed Supreme Court opposes this — that could be a campaign issue for Democrats to use in elections,” Crockett said.

However, the discussion of who this plan would affect is still ongoing. According to Crockett, this financial relief may only affect a small portion of the educational world.

“I don’t know if this is going to affect people with student loans for junior college or community college. I don’t think it has any effect on trade schools [or] vocational programs,” Crockett said.

Hope Paschall, a first-year communication and English double major, received loans, albeit not federal, for Trinity. She has first-hand experience with the dreaded loan application process, but she stated her worry about this plan’s effect on current college students’ futures.

“The future may not necessarily be the greatest as we exit college and enter the workforce,” Paschall said.

Whether or not Paschall’s prediction comes to fruition is entirely based upon the outcome of the court case, though. Crockett even mentions the effect the decision would have on the expansion of presidential power.

“If the court finds that they have standing, then you have a really interesting situation developing. … [It answers the question,] ‘what should presidents be able to do?’” Crockett said.

This plan — and the outcome of its case in court — will affect many students, including those at Trinity, no matter what is decided. However, it may be a while before we hear anything, Crockett warns.

“If people are persistent enough to push this forward, it could end up at the Supreme Court. … This may be a couple years or more,” Crockett said.

Hi! My name is Samara Gerstle (she/her), and I’m the news section editor for the Trinitonian this year! I’m a sophomore, and this is my second year...

I'm Tony Rodriguez! I'm a junior from San Antonio, TX, majoring in math, and I worked as a copy editor for the Trinitonian about two years ago and am now...