Eco Allies presents divestment resolution to Student Government Association

Latest climate change report urges the world to reduce fossil fuel emissions

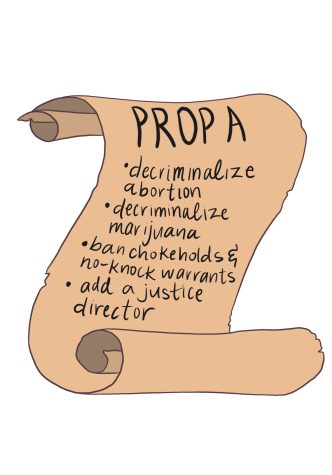

On April 4, the Intergovernmental Panel on Climate Change (IPCC) released the third installment of their Sixth Assessment Report, which focused on how to mitigate the impacts of climate change. The report found that humans must begin to adapt to the impacts that climate change will bring, as well as help lessen the effects by thoroughly reducing the use of fossil fuels. On April 27 Eco Allies, Trinity’s environmental organization, presented a divestment resolution to the Student Government Association (SGA) to encourage Trinity to act on the results of the IPCC report.

Ethan Crane, a senior philosophy major and Eco Allies’ outreach chair, said the goal of the resolution is to inform the Board of Trustees on why it would benefit Trinity and the planet to divest from fossil fuels. The board has the ultimate say on where money is distributed in the university.

In order to present a resolution, a senator must sponsor the cause. Sam Grimsley, a senior triple-majoring in political science, human communication and religion, is the senator that is sponsoring Divest Trinity, the initiative to stop investing in fossil fuels. He said he is doing so because, as the IPCC report points out, action must be taken to prevent the drastic effects of climate change.

“There’s been a movement towards divestment from other colleges like Harvard …. As climate change advances, the fossil fuel industry will probably get the hardest hit,” Grimsley said. “At some point, there’ll be major climate legislation that decreases the value of the fossil fuel industry. It’s just not a sustainable model, so we have to divest at some point. I think there are both practical and just, moral reasons to want to divest the endowment.”

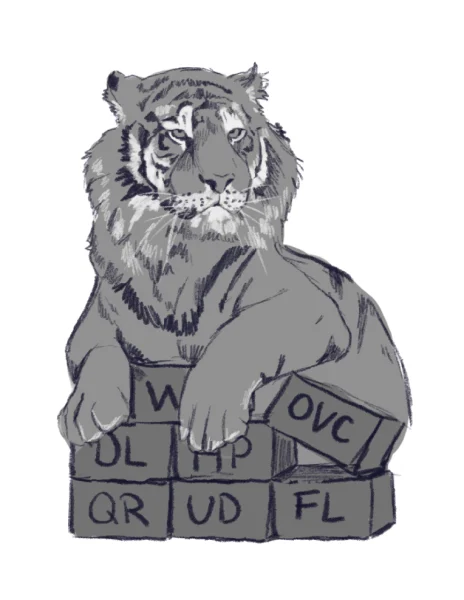

A 1981 New York Times article on Trinity, “Oil Fuels the Lamps of Learning in the Southwest,” points out that the oil industry is rooted in Trinity’s history, which may make it difficult to stray away from investing in petroleum. Although Trinity has close ties to the oil industry, in 2019 Craig Crow the director of investments in the Department of Finance and Administration provided a graph of Trinity’s endowment investments. The graph from a previous Trinitonian article, “Trinity’s deep roots in fossil fuels”, shows that about 96% of Trinity’s endowment comes from industries that are not mineral-oriented. This leaves about 4% of the endowment related to the oil industry. However, in order for the number to lessen, a shift within the market would have to occur.

“Trinity University does not divest investments unless they are underperforming and not helping to meet the University’s obligations. We have an investment team that continually evaluates and adjusts our portfolio based on risk factors and market performance,” Crow wrote in a recent email.

In 2019, Trinity had a $1.3 billion endowment, and the latest endowment report shows that the number grew to $1.7 billion. Although only 4% (about $520 million) of the endowment was related to the petroleum industry in 2019, it is unclear if the Northrup Trust is included in the endowment. The Northrup Trust comes from the Northrup Family, which is invested in the oil industry and has helped fund Trinity since 1952.

Sociology and anthropology professor Richard Reed has been at Trinity for over 30 years and says oftentimes the Northrup Trust is not considered a portion of the endowment because it does not belong to Trinity, but rather the Northrup Family Foundation. Despite this industry connection, Reed noted that he has seen the portion of the petroleum in the endowment shrink for two reasons.

“One, it’s happened because the rest of Trinity’s endowment has grown, so it naturally makes the portion in petroleum stock reduced. That is, the total amount of petroleum stock is still increasing, but the portion that pushes in petroleum is being reduced,” Reed said. “The second reason it’s happening is that Trinity is diversifying its endowment, taking some of the profits that come out of petroleum and investing in other things. Trinity is actively moving away from petroleum into the clean energy field because that’s where stability in the economy is.”

This economic approach to the divestment of fossil fuels is what Crane and Grimsley focused on when presenting to SGA. They said that they know it is not enough to say that divesting is the morally responsible thing to do because the funds of any university involve many different parties with many different stakes. The decision of divesting does not come down to the facts stated by the IPCC report; it comes down to how various industries impact Trinity’s economic standings.

The divestment resolution was adopted by SGA on April 27, which does not mean that Trinity is currently taking action to divest, but that SGA has officially given its endorsement.

According to the report, the world will inevitably continue to experience the consequences of climate change, so what needs to be done now is to reduce emissions to help people adapt to these changes.

“I want the students to think about their role in responding to the climate crisis. In a few years’ time they’ll be thinking back about what they were doing, when they had the agency to act, to do something about it,” Crane said. “When we think like that, it makes the problem a lot more urgent —something we should care about now rather than in some distant future.”

Hello! My name is Ivanna Bass Caldera and I am a first-year student from San Antonio, TX. I am undecided but am interested in majoring in communications....

I'm a senior Computer Science major and a Classical Studies minor from Newton, North Carolina with a passion for art. I also work at the Center for Experiential...